Remittance Inflow to Bangladesh Surges in the First 19 Days of the Current Year

Bangladesh Witnesses Record-Breaking Remittance Surge: Key Insights into Expatriate Contributions and Economic Implication

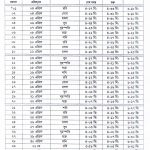

In the initial 19 days of the current year, Bangladesh has witnessed a legal inflow of $13.641 billion from expatriates, equivalent to approximately Tk 15 trillion in local currency, according to the latest report from the Bangladesh Bank.

This substantial figure signifies a remarkable increase in remittances compared to the same period in the preceding year. The remittance inflow for the entire preceding year was $21.90 billion, whereas, in just the first 19 days of the ongoing year, the country has already received a staggering $13.641 billion. This indicates a notable surge in remittance earnings, demonstrating the growing contribution of expatriates to the nation’s economy.

The data reveals a continuous upward trend in remittance inflow over the past few years. In 2022, the remittance earnings stood at $21.30 billion, marking a significant increase from the $20.73 billion received in 2021. The year 2020 also witnessed a positive trajectory with remittance earnings reaching $17.33 billion. Furthermore, in 2019, the country received $8.33 billion in remittances. These statistics underscore the consistent growth in remittance earnings over the past five years.

Analyzing the data, experts emphasize that the increase in remittance earnings does not align with the population growth rate. Despite a significant rise in the number of people entering the workforce each year, the corresponding increase in remittance earnings does not mirror this trend. This raises questions about the factors contributing to the substantial surge in remittance inflow.

According to Central Bank information, December of the preceding year witnessed the highest remittance inflow in the last six months. In this month alone, expatriates sent $1.99 billion to their home country, surpassing the $2.19 billion received in June of the same year.

In the first 19 days of January, various banks facilitated the inflow of remittances, with nationalized banks receiving $110 million, specialized agricultural banks receiving $20.88 million, private banks receiving $1.22 billion, and foreign banks channeling $4.1 million in American dollars into the country.

Over the last two years, due to the foreign exchange crisis, the official exchange rate of the US dollar against the Bangladeshi Taka has surged from Tk 86 to Tk 110. Despite this, banks are purchasing dollars at a rate that is Tk 120 higher than the official exchange rate to meet their import obligations. This has resulted in banks paying higher rates for remittances compared to the official exchange rate.

Despite the challenges posed by the exchange rate, the country has not experienced a significant decline in remittance inflow. The consistent rise in remittance earnings is indeed noteworthy, especially considering the global economic uncertainties and the impact of the COVID-19 pandemic.

In conclusion, the surge in remittance inflow during the initial days of the current year is a positive indicator for Bangladesh’s economy. Expatriates continue to play a crucial role in supporting the nation’s financial stability, even amidst challenging global circumstances. The government and financial institutions must collaborate to address the exchange rate challenges and ensure that the benefits of increased remittance earnings are effectively utilized for the country’s development.

Share